12

2016 PPG ANNUAL REPORT AND FORM 10-K

Backlog

In general, PPG does not manufacture its products against a

backlog of orders. Production and inventory levels are geared

primarily to projections of future demand and the level of

incoming orders.

Global Operations

PPG has a significant investment in non-U.S. operations.

This broad geographic footprint serves to lessen the significance

of economic impacts occurring in any one region on PPG’s total

net sales and income from continuing operations. As a result of

our expansion outside the U.S., we are subject to certain inherent

risks, including economic and political conditions in

international markets and fluctuations in foreign currency

exchange rates. During 2016, unfavorable foreign currency

reduced net sales by approximately $400 million.

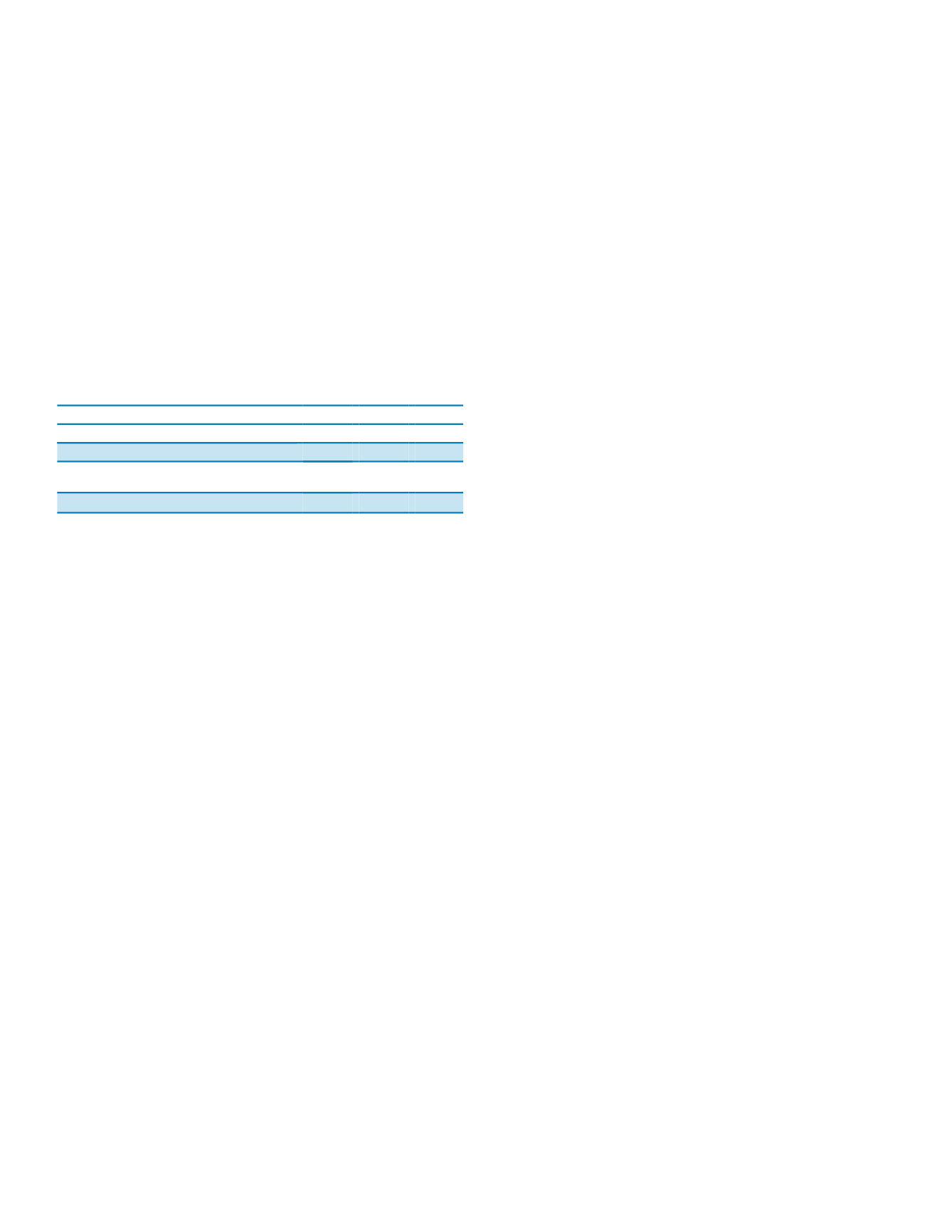

Our net sales in the developed and emerging regions of the

world for the years ended December 31

st

are summarized below:

($ in millions)

Net Sales

2016

2015 2014

United States, Canada, Western Europe

$10,196

$10,145 $10,657

Latin America, Central and Eastern Europe,

Middle East, Africa, Asia Pacific

4,555

4,621 4,134

Total

$14,751

$14,766 $14,791

Refer to Note 19, “Reportable Business Segment

Information” under Item 8 of this Form 10-K for geographic

information related to PPG’s property, plant and equipment, and

for additional geographic information pertaining to sales.

Seasonality

PPG’s income from continuing operations has typically

been greater in the second and third quarters and cash from

operating activities has been greatest in the fourth quarter due to

end-use market seasonality, primarily in PPG’s architectural

coatings businesses. Demand for PPG’s architectural coatings

products is typically the strongest in the second and third

quarters due to higher home improvement, maintenance and

construction activity during the spring and summer months in

the U.S. and Canada and Europe. The Latin America paint

season is the strongest in the fourth quarter. These higher activity

levels result in higher outstanding receivables that are collected

in the fourth quarter generating higher fourth quarter cash from

operating activities.

Employee Relations

The average number of persons employed worldwide by

PPG during 2016 was about 47,000. The Company has

numerous collective bargaining agreements throughout the

world. We observe local customs, laws and practices in labor

relations when negotiating collective bargaining agreements.

There were no significant work stoppages in 2016. While we

have experienced occasional work stoppages as a result of the

collective bargaining process and may experience some work

stoppages in the future, we believe that we will be able to

negotiate all labor agreements on satisfactory terms. To date,

these work stoppages have not had a significant impact on PPG’s

results of operations. Overall, the Company believes it has good

relationships with its employees.

Environmental Matters

PPG is subject to existing and evolving standards relating to

protection of the environment. PPG is negotiating with various

government agencies concerning 126 current and former

manufacturing sites and offsite waste disposal locations,

including 24 sites on the National Priority List. While PPG is not

generally a major contributor of wastes to these offsite waste

disposal locations, each potentially responsible party may face

governmental agency assertions of joint and several liability.

Generally, however, a final allocation of costs is made based on

relative contributions of wastes to the site. There is a wide range

of cost estimates for cleanup of these sites, due largely to

uncertainties as to the nature and extent of their condition and

the methods that may have to be employed for their remediation.

The Company has established reserves for onsite and offsite

remediation of those sites where it is probable that a liability has

been incurred and the amount of loss can be reasonably

estimated.

The Company’s experience to date regarding environmental

matters leads it to believe that it will have continuing

expenditures for compliance with provisions regulating the

protection of the environment and for present and future

remediation efforts at waste and plant sites. Management

anticipates that such expenditures will occur over an extended

period of time.

In addition to the $285 million currently reserved for

environmental remediation efforts, we may be subject to loss

contingencies related to environmental matters estimated to be

approximately $100 million to $200 million. These reasonably

possible unreserved losses relate to environmental matters at a

number of sites, none of which are individually significant. The

loss contingencies related to these sites include significant

unresolved issues such as the nature and extent of contamination

at these sites and the methods that may have to be employed to

remediate them.

Capital expenditures for environmental control projects

were $18 million, $15 million and $14 million in 2016, 2015,

and 2014, respectively. It is expected that expenditures for such

projects in 2017 will be in the range of $10 million to $20

million. Although future capital expenditures are difficult to

estimate accurately because of constantly changing regulatory

standards and policies, it can be anticipated that environmental

control standards will become increasingly stringent and the cost

of compliance will increase.

In management’s opinion, the Company operates in an

environmentally sound manner, is well positioned, relative to

environmental matters, within the industries in which it operates

and the outcome of these environmental contingencies will not

have a material adverse effect on PPG’s financial position or

liquidity; however, any such outcome may be material to the

results of operations of any particular period in which costs, if

any, are recognized. See Note 13, “Commitments and

Contingent Liabilities,” under Item 8 of this Form 10-K for

additional information related to environmental matters and our

accrued liability for estimated environmental remediation costs.

Public and governmental concerns related to climate change

continue to grow, leading to efforts to limit the greenhouse gas

(“GHG”) emissions believed to be responsible. While PPG has

operations in many countries, a substantial portion of PPG’s