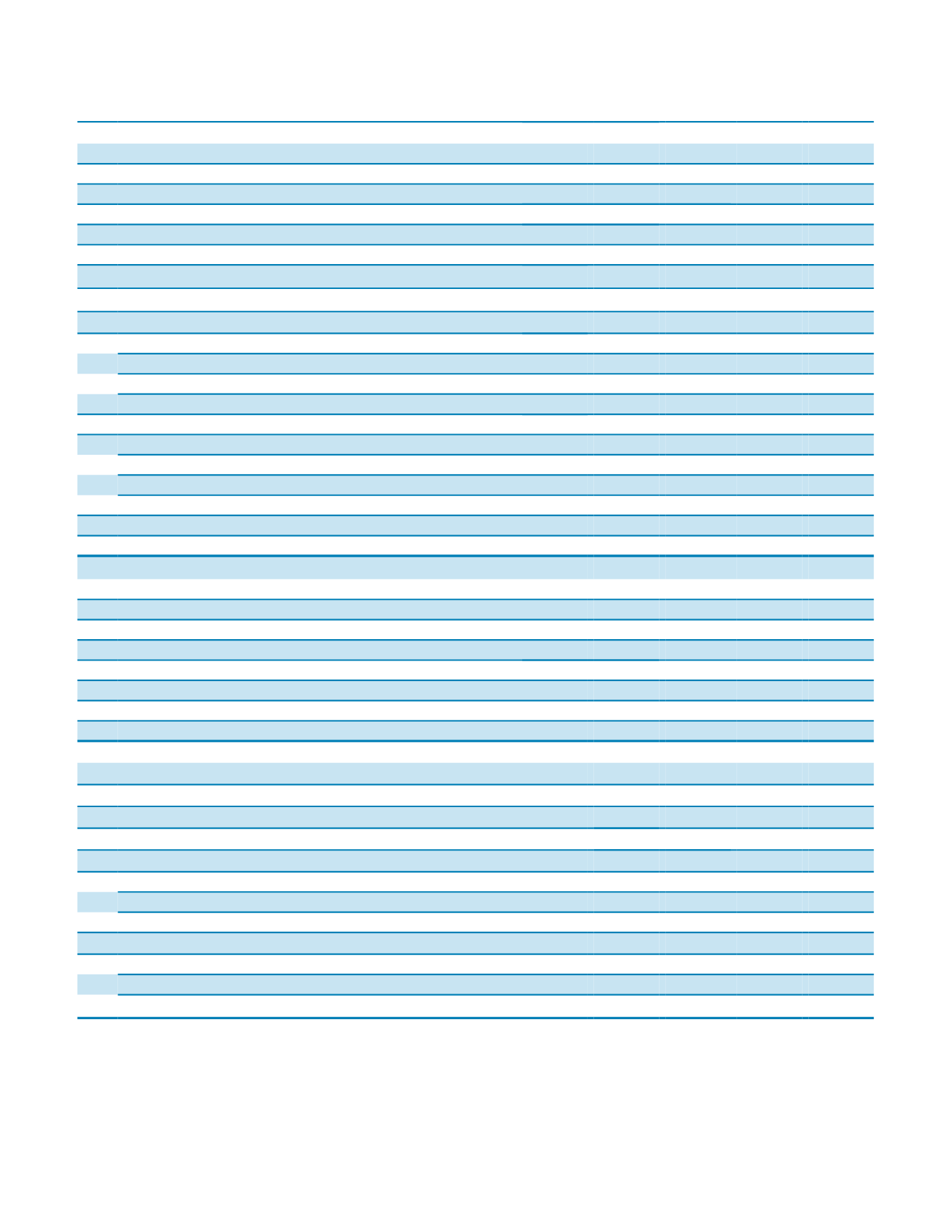

86

2016 PPG ANNUAL REPORT AND FORM 10-K

Five Year Digest

All amounts are in millions of dollars except per share data, percentages and number of employees

2016

2015

2014

2013

2012

Consolidated Statement of Income

Net sales

$ 14,751

$ 14,766 $ 14,791 $ 13,736 $ 12,169

Income before income taxes

827

1,783 1,346 1,204

813

Income tax expense

241

424

237

249

146

Net income from continuing operations (attributable to PPG)

564

1,338 1,085

932

649

Net income from discontinued operations (attributable to PPG)

313

68 1,017 2,299

292

Net income (attributable to PPG)

877

1,406 2,102 3,231

941

Return on average capital (%)

(1) †

7.0

15.8

13.9

14.2

14.9

Return on average equity (%)

†

11.3

27.4

19.5

22.0

26.3

Earnings per common share:

Continuing Operations

2.12

4.93

3.92

3.25

2.12

Discontinued Operations

1.18

0.25

3.68

8.01

0.95

Net income (attributable to PPG)

3.30

5.18

7.60 11.26

3.07

Weighted average common shares outstanding

265.6

271.4 276.6 286.8 306.8

Earnings per common share - assuming dilution:

Continuing Operations

2.11

4.89

3.88

3.22

2.09

Discontinued Operations

1.17

0.25

3.64

7.92

0.94

Net income (attributable to PPG)

3.28

5.14

7.52 11.14

3.03

Adjusted weighted average common shares outstanding

267.4

273.6 279.6 290.2 310.2

Dividends paid on PPG common stock

414

383

361

345

358

Per Share

1.56

1.41

1.31

1.21

1.17

Consolidated Balance Sheet

Current assets

$ 6,452

$ 6,712 $ 6,602 $ 6,956 $ 7,447

Current liabilities

4,240

4,695 4,928 4,174 4,503

Working capital

2,212

2,017 1,674 2,782 2,944

Property, plant and equipment (net)

2,759

2,822 2,895 2,666 2,681

Total assets

15,769

17,076 17,535 15,804 15,811

Long-term debt

3,787

4,026 3,516 3,339 3,332

Total PPG shareholders' equity

4,826

4,983 5,180 4,933 4,063

Per share

18.05

18.21 18.53 17.00 13.10

Other Data

Capital Spending

(2)

751

774 2,677 1,446

437

Depreciation expense

341

339

324

306

264

Amortization expense

121

132

126

119

107

Interest expense

125

125

187

195

208

Quoted market price

(4)

High

117.00

118.95 116.84 95.04 68.40

Low

88.37

82.93 85.78 64.10 41.64

Year end

94.76

98.82 115.58 94.83 67.68

Price/earnings ratio

(3)

High

55

24

30

30

33

Low

42

17

22

20

20

Average number of employees

†

47,000

46,600 44,400 41,400 39,200

(1) Return on average capital is calculated using pre-interest, after-tax earnings and average debt and equity during the year.

(2) Includes the cost of businesses acquired.

(3) Price/earnings ratios were calculated based on high and low market prices during the year and the respective year's earnings per common share.

(4) On April 16, 2015, the PPG Board of Directors approved a 2-for-1 split of the company's common stock. PPG common stock began trading on a split-

adjusted basis on June 15, 2015. All historical per share and share data give retroactive effect to the 2-for-1 stock split.

† From continuing operations, as originally reported.

Amounts in the table above have been recast to present the results of the flat glass, the former commodity chemicals, and PPG's former interest in Transitions

Optical and sunlens businesses as discontinued operations except where otherwise noted. Further, historical balance sheet information has been recast to reflect

the assets and liabilities of the flat glass business as held for sale, as well as the adoption of new Accounting Standards Updates in 2015.