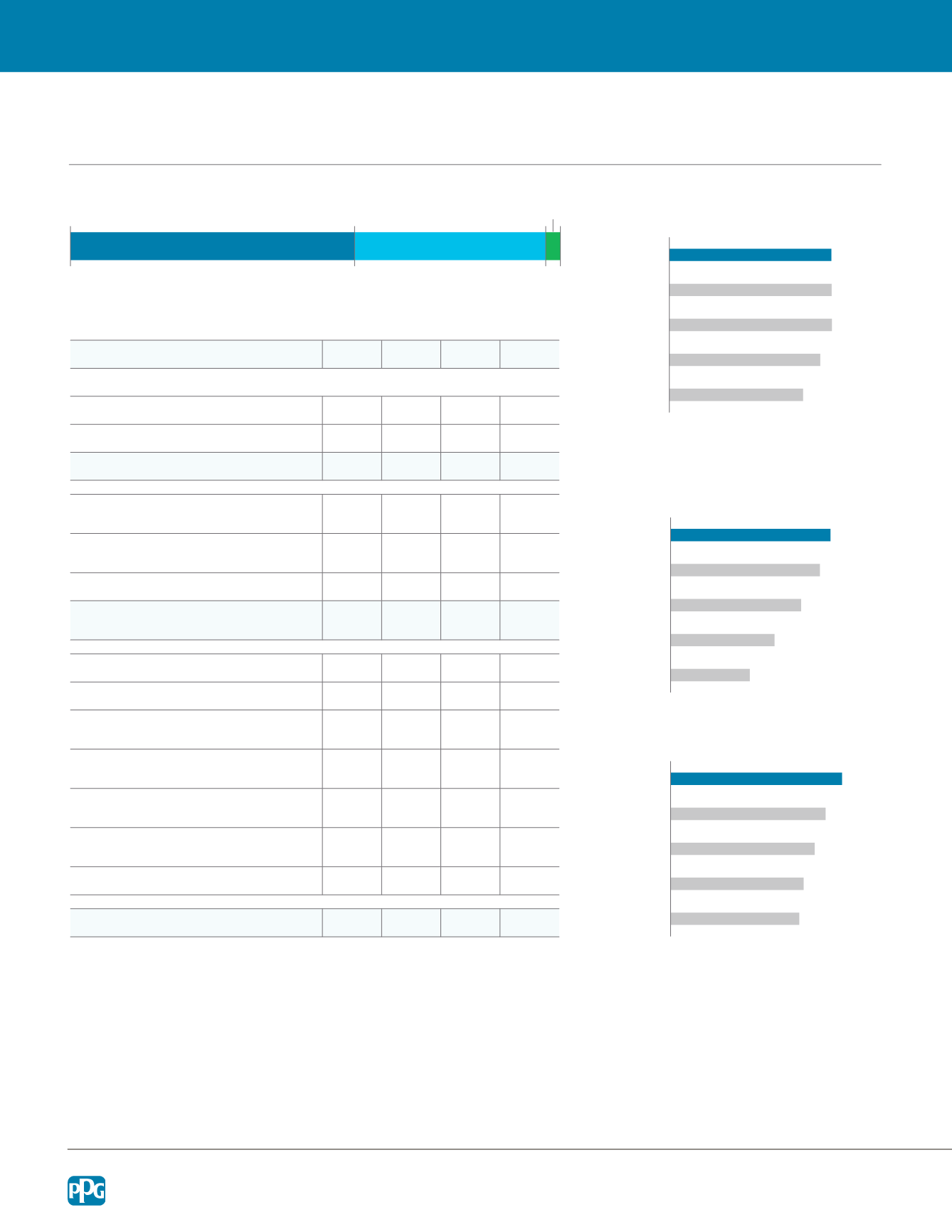

2016 Financial Overview and Shareholder Information

$12,169

$13,736

$14,791

$14,766

$14,751

2012

2013

2014

2015

2016

$2.88

$3.78

$4.75

$5.43

$5.82

2012

2013

2014

2015

2016

$1.17

$1.21

$1.31

$1.41

$1.56

2012

2013

2014

2015

2016

1 Net income from continuing operations, earnings per diluted share from continuing operations and return on average capital decreased year-over-year primarily due to pension settlement

charges of $616 million (after-tax) or $2.31 per diluted share recorded in conjunction with the transfer of certain U.S. and Canadian pension benefit obligations and assets to several highly rated

insurance companies; as well as a net tax charge of $151 million or $0.57 per diluted share associated with the funding of the Pittsburgh Corning asbestos settlement trust.

2 Includes an after tax gain of $267 million or $1.01 per diluted share resulting from the sale of our flat glass business in 2016.

3 Adjusted amounts in 2016, 2015 and 2014 exclude after tax net charges of $3.71, $0.54 and $0.87, respectively, which are included in reported earnings per diluted share. For detailed

information regarding these adjustments, see the Regulation G Reconciliation in Item 7 of the Form 10-K. Adjusted amounts in 2013 exclude per diluted share amounts of $0.25 for business

restructuring; $0.22 for environmental remediation; $0.08 for transaction-related costs; and $0.04 for legacy pension settlement charges. The adjusted amounts are reduced by $0.03 for the

retroactive benefit of a U.S. tax law change. Adjusted amounts in 2012 exclude per diluted share amounts of $0.45 for business restructuring; $0.32 for environmental remediation; and $0.02

for transaction-related costs.

4 On April 16, 2015, the PPG Board of Directors approved a 2-for-1 split of the company's common stock. PPG common stock began trading on a split-adjusted basis on June 15, 2015.

All historical per share and share data give retroactive effect to the 2-for-1 stock split.

5 Operating cash flows from continuing operations decreased year-over-year primarily due to the Company fully satisfying its funding obligation to the Pittsburgh Corning asbestos settlement

trust of approximately $800 million (pre-tax) or approximately $630 million (after-tax).

2016 2015

$

Change

%

Change

Net sales

$ 14,751 $14,766 $ (15)

0%

Net Income (attributable to PPG)

Income from continuing operations

1

$ 564 $ 1,338 $ (774)

(58%)

Income from discontinued operations

2

$ 313 $

68 $ 245

360%

Net income

1, 2

$ 877 $ 1,406 $ (529)

(38%)

Earnings per diluted share from

continuing operations

1

$ 2.11 $ 4.89 $ (2.78)

(57%)

Earnings per diluted share from

discontinued operations

2

$ 1.17 $ 0.25 $ 0.92

368%

Total earnings per diluted share

$ 3.28 $ 5.14 $ (1.86)

(36%)

Adjusted earnings per diluted share

from continuing operations

3

$ 5.82 $ 5.43 $ 0.39

7%

Dividends per share

$ 1.56 $ 1.41 $ 0.15

11%

Return on average capital

1

7.0% 15.7% (8.7%)

(55%)

Operating cash flow

(from continuing operations)

5

$ 1,241 $ 1,735 $ (494)

(28%)

Capital spending (from continuing

operations including business acquisitions)

$ 751 $ 774 $ (23)

(3%)

Research and development

(from continuing operations)

$ 487 $ 494 $

(7)

(1%)

Average shares outstanding —

assuming dilution

267.4

273.6

(6.2)

(2%)

Average number of employees

47,000 46,600

400

1%

PPG shareholders' equity

$ 4,826 $ 4,983 $ (157)

(3%)

Net Sales ($ MM)

from continuing operations

Financial Overview

Net Sales by Reportable Segment

Adjusted Earnings per

Diluted Share

3, 4

from continuing operations

Dividends per Share

4

Performance Coatings 58%

Glass 3%

Industrial Coatings 39%

PPG ANNUAL REPORT AND FORM

K